Mitsubishi Corporation: A Deep Dive into Financial Health and Future Prospects

Mitsubishi Corporation (MC) is a global conglomerate with a vast and diverse portfolio spanning energy, materials, machinery, chemicals, and more. Determining its precise net worth is a complex undertaking, given the fluctuating nature of global markets and the sheer breadth of its operations. This article analyzes MC's financial health, exploring its diversified business model, navigating the challenges and opportunities it faces, and examining its potential future trajectory. Understanding MC's financial strength requires analyzing key trends, profitability across its divisions, and key financial indicators rather than focusing solely on a single net worth figure.

Mitsubishi's Diversified Portfolio: A Strength and a Challenge

Mitsubishi's expansive portfolio is both its greatest strength and its most significant challenge. This diversification acts as a buffer against economic downturns in individual sectors. If one area experiences a decline, others can offset the losses. However, managing such a diverse range of businesses requires significant expertise in navigating various markets, regulatory landscapes, and economic trends. How effectively Mitsubishi manages this complexity directly impacts its overall financial health. This inherent complexity makes pinpointing a precise net worth extremely difficult.

Navigating Headwinds and Tailwinds: Challenges and Opportunities

Mitsubishi faces significant external challenges, including geopolitical risks (disruptions to supply chains, price fluctuations in resources), the global energy transition (shifting away from fossil fuels), rapid technological advancements (disruption to existing business models), and intense competition within each of its various sectors. However, it also possesses significant opportunities. Strategic investments in renewable energy technologies (such as lithium-ion batteries) position the company to benefit from the growth of sustainable energy markets. Furthermore, its ability to adapt and innovate across its diverse business units will be crucial in determining its future success. Doesn't this strategic agility make you wonder about their long-term financial prospects?

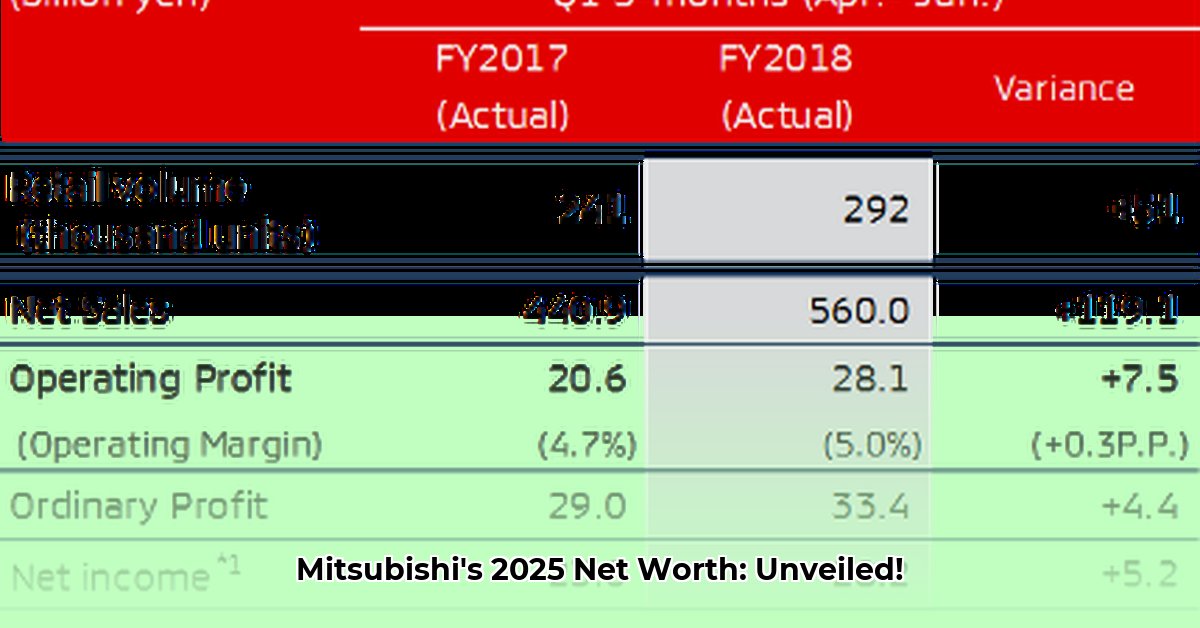

Financial Performance Analysis: Unveiling Key Trends

Precisely determining Mitsubishi's net worth is practically impossible without access to internal, non-public financial data. However, analyzing publicly available financial statements reveals key trends. Examining yearly reports and focusing on indicators like profitability across divisions, revenue consistency, and debt levels offers a more nuanced understanding of its financial health than a single, elusive net worth figure. Consistent profitability across diverse sectors—a testament to their risk mitigation strategies—suggests robust financial health.

Future Outlook: Key Factors Shaping Mitsubishi's Trajectory

Mitsubishi's future financial performance hinges on several key factors. The success of its investments in renewable energy and sustainable technologies will be critical. Its ability to navigate geopolitical uncertainty and maintain its competitive edge across diverse markets will also significantly influence its future trajectory. Strategic partnerships, technological innovation, and a commitment to environmental responsibility will be instrumental in ensuring long-term success. How successfully can they balance these multiple needs?

Conclusion: A Resilient Giant in a Changing World

Mitsubishi Corporation operates in a complex and dynamic global environment. While a precise net worth remains elusive, analyzing key financial indicators and strategic positioning provides a comprehensive understanding of its financial health. Its diversified portfolio, strategic investments, and commitment to innovation suggest a company well-positioned to navigate the challenges and capitalize on the opportunities of the future. Their resilience and adaptability are clear signals of continued success, even in the face of unprecedented global uncertainty. The long-term financial success of Mitsubishi will depend on its continued ability to successfully manage both its diverse operational landscape and the risks inherent in a globally interconnected economy.

Key Takeaways:

- Mitsubishi Corporation's diversified portfolio provides resilience against sector-specific downturns.

- Strategic investments in sustainable technologies position the company for future growth.

- Navigating geopolitical risks and maintaining competitiveness are paramount for long-term success.